|

Wine consumers are mainly concentrated in East China

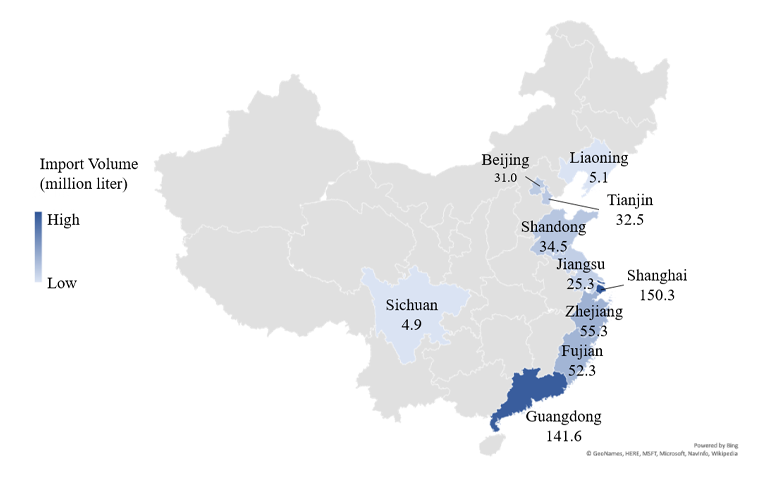

To no one’s surprise, grape wine has gained popularity in cities of Eastern China, given the growing prosperity and rising middle class of those cities. In fact, the two major economic powerhouses in China – Pearl River Delta and Yangtze River Delta – dominate the wine market in terms of consumption volume. According to the statistics of the General Administration of Customs of China (GACC), Shanghai, Guangdong Province and Zhejiang Province have the highest import volume of wine in China, which accounted for 27.3%, 25.6%, and 10.0%, respectively, representing a total of 62.9% of the total import volume in China.

Additionally, wine knowledge and culture are well developed and rooted in first and second-tier cities of China. The more affluent consumers in China have developed a habit of enjoying wine on a regular basis. In contrast, such consumption habit among consumers in third and fourth-tier cities is yet to emerge. Wine market in these regions will require further cultivation and education. Given the population size in these regions, coupled with growing disposable income, wine consumption in those cities is expected to pick up, creating new growth drivers of the wine market.

The map below sets forth the top 10 cities/provinces in terms of import volume of wine in China in 2017:

Personal consumption of wine is emerging, and the average price of wine purchased by Chinese consumers ranged from 100 RMB to 200 RMB

As wine culture continues to develop in China, the market is witnessing the acceleration of personal consumption of wine. The young middle class are less concerned about the “big names” in wine for gifting, and would rather choose the wine with suitable price and taste to enjoy it with friends. According to Wine Intelligence, Chinese consumers are shifting towards wine purchased for own consumption from wine purchased for business occasions or gifting. About 56% of wine consumers in China believe drinking wine is good for health, while about 51% of the wine consumers believe drinking wine helps relax physically and mentally.

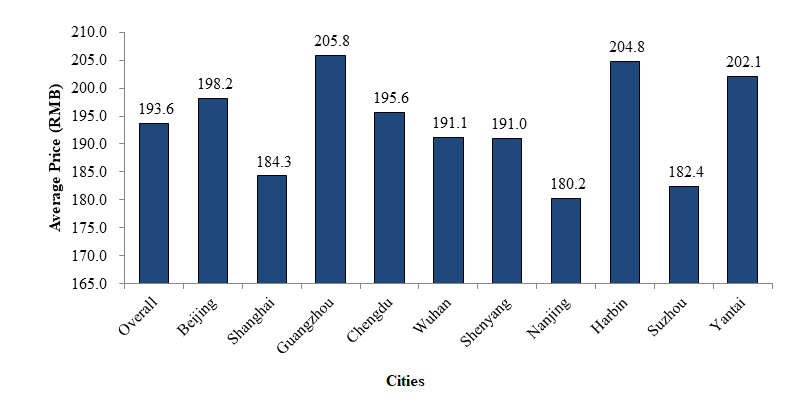

As such, instead of purchasing premium and expensive wine for business or gifting needs in the past, now that the trend of wine personal consumption is emerging, and Chinese consumers tend to purchase wine based on personal flavors at a more affordable price range. In accordance with the survey conducted by the Hong Kong Trade Development Council (HKTDC) in 2017, the average price of wine purchased by Chinese consumers ranges from 100 RMB to 200 RMB per bottle. The average price of wine bought for personal consumption was approximately 193.6 RMB per bottle. The average price in the surveyed cities ranged from 180 to 206 RMB per bottle. In this respect, low-priced wine, both domestically produced and imported, started to dominate the wine market in China.

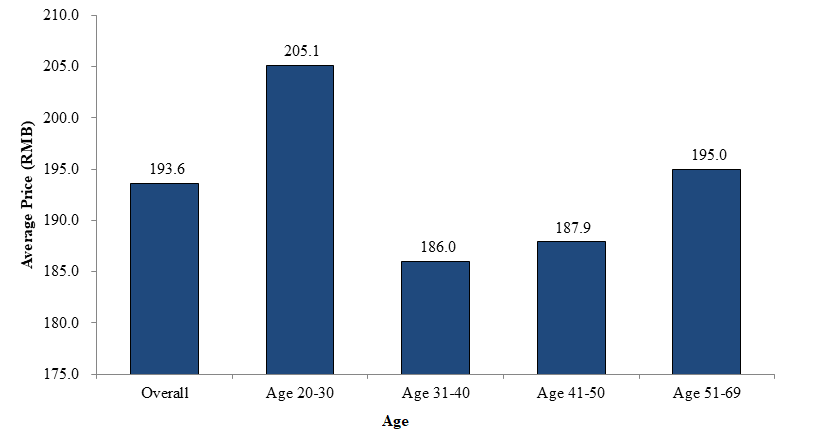

Additionally, young urban wine consumers are more willing to spend on wines. The average price of wine bought for own consumption was the highest for the young adults aged from 20 to 30 among all age groups, according to the HKTDC survey. With the expected growth of disposable income and continuous development of wine culture, the young adult group is expected to be a major demand driver of the wine market.

The chart below sets forth the average price of wine bought for own consumption by different cities in China:

Sources: HKTDC; ShineWing Sources: HKTDC; ShineWing

The chart below illustrates the average price of wine bought for own consumption by age:

Sources: HKTDC; ShineWing Sources: HKTDC; ShineWing

Female wine drinkers appear to be a potential market segment in China

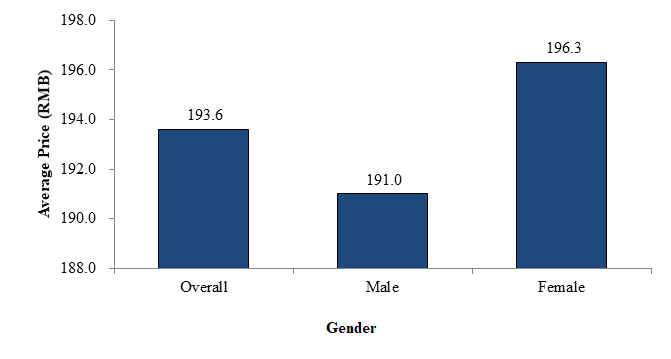

Female wine drinkers may be the next rising market segment. Compared to male consumers, female consumers are generally more willing to spend money on grape wine. Also, the expenditure on grape wine over total expenditure on all kinds of alcohol online is higher for female consumers than that of male consumers. This figure suggests that grape wine is more acceptable to female consumers among other types of alcohol.

The chart below illustrates the average price of wine bought for own consumption by gender:

Sources: HKTDC; ShineWing Sources: HKTDC; ShineWing

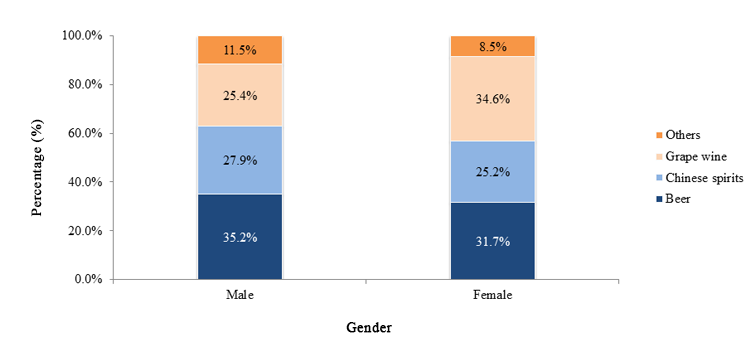

The chart below illustrates the distribution of total expenditure online on all kinds of alcohol by gender:

Sources: Exactdata (易知數據); ShineWing Sources: Exactdata (易知數據); ShineWing

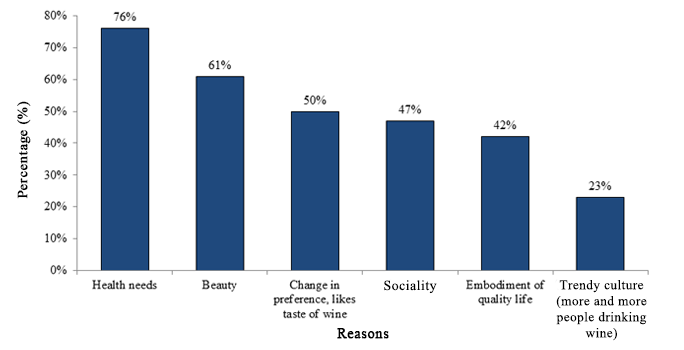

The trend of female consumers as an emerging market segment mainly benefits from the perception of female in wine. According to the HKTDC, beauty is the second major reason for female consumers to drink wine. The perception towards drinking wine for beauty benefits may potentially help drive the demand for wine from female consumers in China.

The following chart sets forth the percentage of the main reasons for female consumers to drink wine:

Sources: HKTDC; ShineWing Sources: HKTDC; ShineWing

As wine flavor is increasingly becoming the key factor in wine choice, wine in sweet and fruity flavor with medium acidity is more popular among female consumers, and is likely to be a growing category of the wine market. As fruity-driven flavor wine is generally more acceptable, consumers tend to favor sweet and fruity style grape wine as opposed to the drier counterparts, particularly for female drinkers. A similar observation has also been suggested by a research conducted by the Beijing University of Agriculture, which female consumers prefer wine with higher sweetness, while male consumers prefer wine with bitterness and tannins.

Online sales platforms will be an emerging sales channel of wine

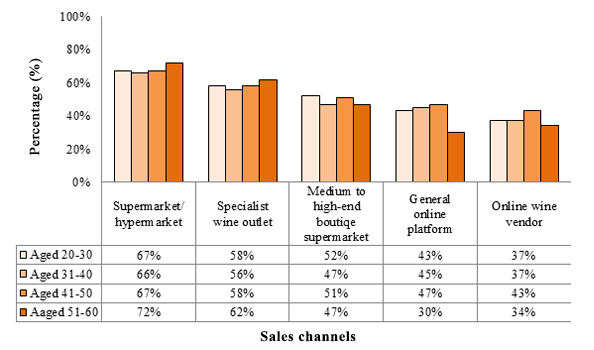

Similar to other consumer products, online retailing is booming in China and it has reshaped the consumer behavior for purchasing wine. Online sales platforms, especially Tmall, Taobao and Jingdong, are generating a considerable online sales volume. Consumers aged from 41 to 50, in particular, tend to purchase wine from online sales platforms more than other age groups do, according to the HKTDC.

The following chart illustrates the percentage of each age group buying wine through different sales channels:

Note: The above percentage represents the percentage of respondents purchasing wine from the respective sales channels Note: The above percentage represents the percentage of respondents purchasing wine from the respective sales channels

Sources: HKTDC; ShineWing

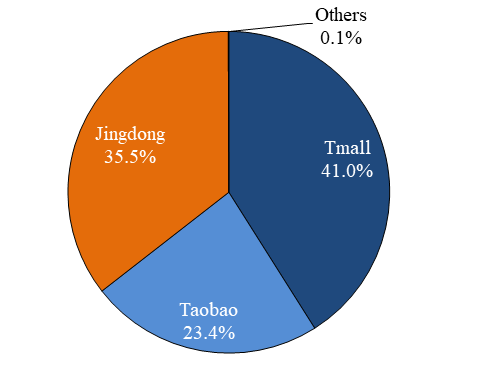

The chart below sets forth the percentage of total online wine sales volume at different online sales platform in 2017 (between January and November):

Sources: Exactdata (易知數據); ShineWing Sources: Exactdata (易知數據); ShineWing

According to Exactdata, Tmall, Taobao and Jingdong are the online retail giants which accounted for aggregate 99% of the total online sales volume. Tmall appears to be the largest online sales platform for wine.

The popularity of the new found sales channel maybe partially attributed to the fact that consumers are more likely to obtain wine information online. Wine information, such as taste, price and customer review, is easily accessible on the website as opposed to buying wine in bricks-and-mortar stores. Consumers can easily compare wines with different features and prices online, and that facilitates the purchasing process. Also, not only do online platforms offer comprehensive wine information, they also provide a complete end-to-end solution for overseas wine exporters who are struggling to get their products delivered to consumers. By striking a deal with these online retail platforms, they will be able to deliver their products to overseas customers.

Today, online sales platforms in China have become an important distribution channel for overseas wine exporters. In terms of both sales volume and sales value, more than 75% of wine sold through online platforms in 2017 was imported wine while the rest was domestically produced. To make the supply chain even more complete, Chinese retail giants have their merchandisers travelling to overseas vineyards for wine tasting and procurements, offering a broad range of overseas wine labels to consumers and sell millions of bottles a year.

If there are any aspects which we may assist, please do not hesitate to contact:

Partner - Mr. Kevin Lam

Kevin.lam@shinewing.hk (Tel. 3583 8000)

Assistant Manager - Mr. Tom Huang

Tom.Huang@shinewing.hk (Tel. 3748 8231) |

|