|

Introduction

The US-China trade war has stretched into mid-2019, though the bitter trade disputes between the US and China are at standstill. The US Farm Belt is fighting hard to prevent the loss of its best customer for its biggest export. The customer is China and the export is soybeans, of which the US shipped around $21 billion abroad in 2017, far more than anything else farmers grow.

On 6 July 2018, China imposed 25% tariff on soybean import from the US. Imposing tariff on U.S soybean was a vehement retaliatory measure undertaken by China at the negotiation table with the US. Indeed, the tariff hit the agricultural industry, and may hit it hard, in the US Yet, this tactic is also deemed to be a double-edged sword. China may backfire on its domestic economy in the long term caused by imposing the tariff on soybean. This is because China heavily relies on the import of soybeans from the US. China cannot simply identify a suitable alternative supplier around the world even it still has an existing soybean supply from Brazil.

China’s predicament in the soybean trade

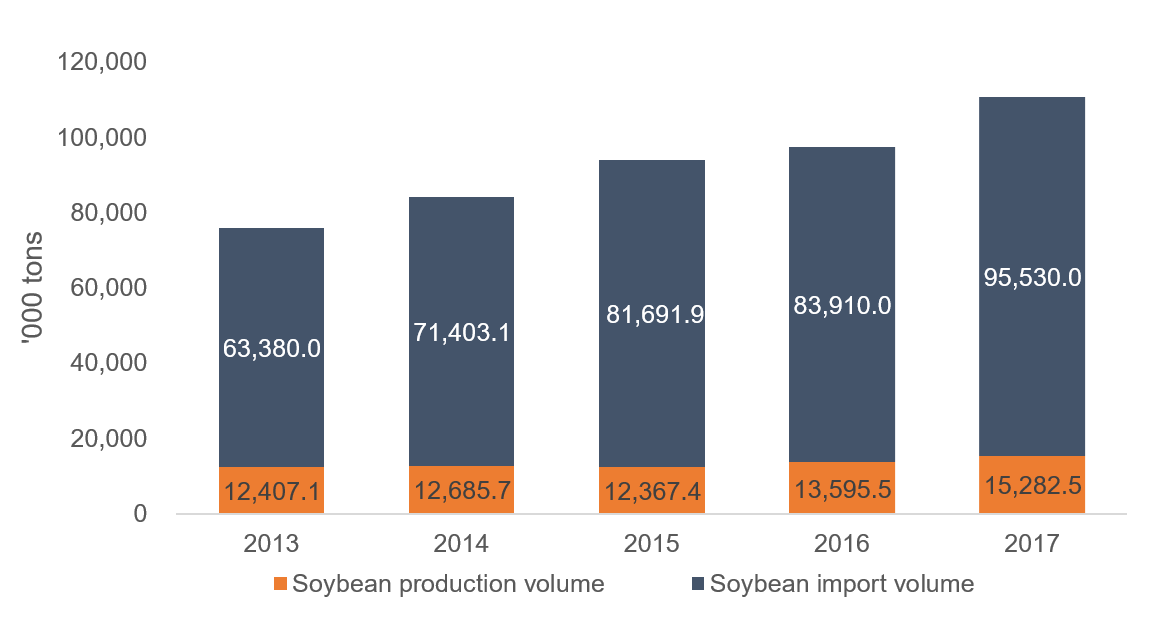

China is highly dependent on the import of soybeans from other countries to meet its domestic demand given its low domestic production of soybean. According to the National Bureau of Statistics of China, the domestic production of soybean in 2017 was 15.3 million metric tons, while the import volume was about 95.5 million metric tons in the same year. Import volume of soybean accounted for 86% of the demand in China.

The chart below sets forth the import and production volume of soybean in China from 2013 to 2017:

Sources: National Bureau of Statistics of China; ShineWing research and analysis Sources: National Bureau of Statistics of China; ShineWing research and analysis

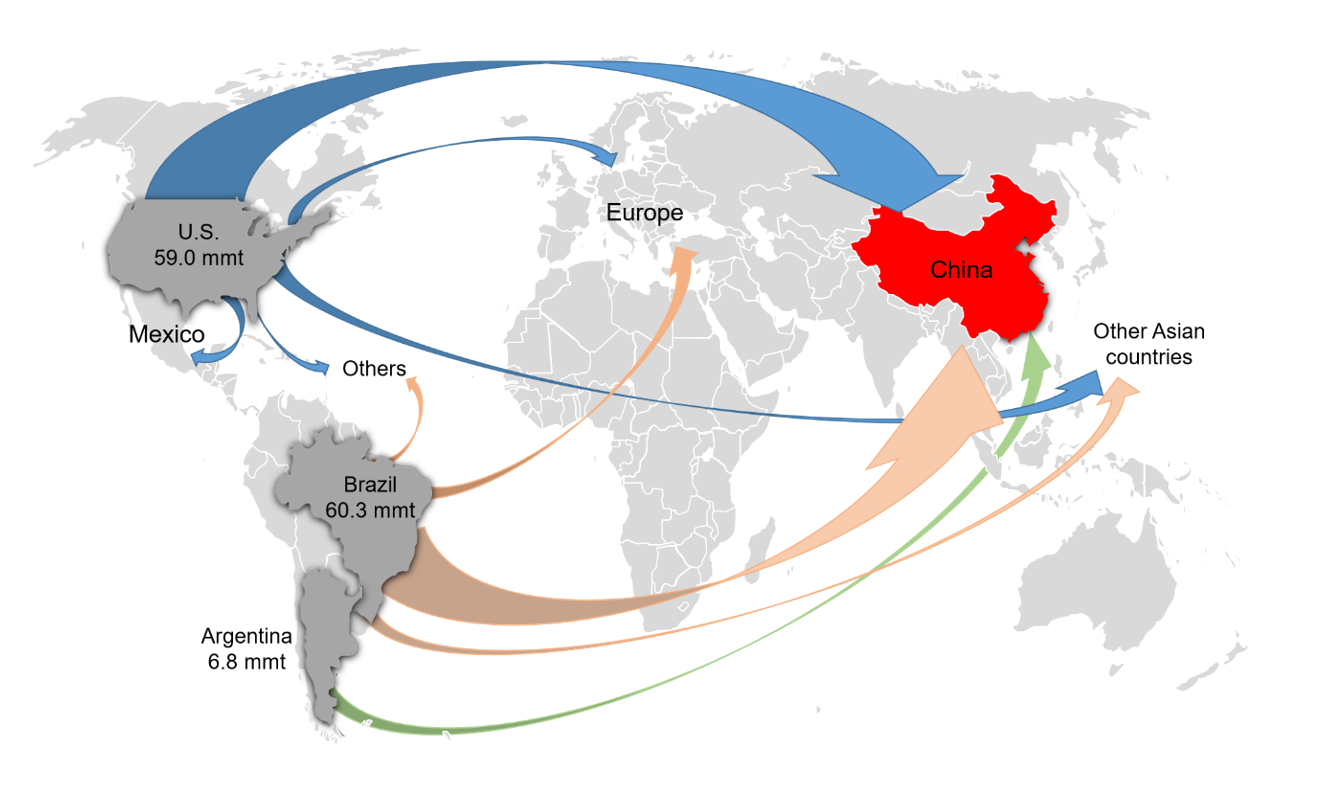

In the global soybean market, the US and Brazil are the two largest countries producing soybeans, and they are also the major soybean importing origins to China and other countries. In 2017, the US and Brazil together accounted for 83% of the world’s total export volume of soybean, while China’s total import volume of soybean from the US and Brazil was about 80%. In terms of import volume, China is the world’s largest buyer of soybeans.

Note: The width of the arrow represents the export volume and the “mmt” refers to million metric tons. Note: The width of the arrow represents the export volume and the “mmt” refers to million metric tons.

Source: ERS analysis of customs data from IHS Global Insight

China’s soybean demand is driven by the production of animal protein and edible oil. The expansion of the soybeans crushing and processing sector for the production of soybean meals and edible oil is the key factor propelling the soybean import over the past decades. The imported soybeans are used to produce (1) edible oil – generally used to blend with other oils for use in cooking by consumers, food services sector and food processing sector, and (2) soybean meals – low cost protein added to animal feeds. According to the US of Department of Agriculture (USDA), each 1,000 kg of imported soybeans in China yields approximately 800 kg of soybean meals and 180 kg of edible oil. Almost all of these products produced from imported soybeans are consumed by livestock and consumers in China respectively. In contrast, soybeans produced in China are mainly used to produce food such as tofu, soybean milk, soy sauce, nutritional supplements ,etc. Consumption of these products has also grown but not at the pace of edible oil and soybean meals. As a result, importing soybean allows China to increase the productivity of livestock husbandry and expand the supply of edible oils that are important to raise the living standard of Chinese citizens.

Can China develop homegrown soybeans to reduce its reliance on import? One of the main reasons that China needs to import a large volume of soybean is that China does not possess the comparative advantages of planting soybeans. Planting soybeans in China is less appealing to farmers than planting other crops, such as corns, as the automation of soybean plantation in China has not fully realized yet and planting soybeans yields a lower financial return. Unlike the US, one of the competitors, soybean plantation in the US is primarily fully-automated by the adoption of drones and other machinery. Low automation of production, as well as high production cost in China, inevitably lower the profit or even cause net loss for soybean growers. Relatively, planting other crops are more profitable to farmers, giving rise to the low domestic production volume of soybeans.

The high reliance on import is also partly resulted from the regulatory environment in China. The Chinese government prohibits planting genetically modified (GM) soybeans in China but allows GM soybeans imported from overseas. The imported soybeans in China today are mostly GM soybeans, enabling higher yield of edible oil after crushing than those non-GM soybeans grown in China. It is, therefore, more economically effective to choose imported soybean for edible oil production. Under the background of ever-growing soybean demands in China, importing soybeans appears to be an economically effective and inevitable approach.

Imposing tariff on the US soybeans may backfire China’s soybean market

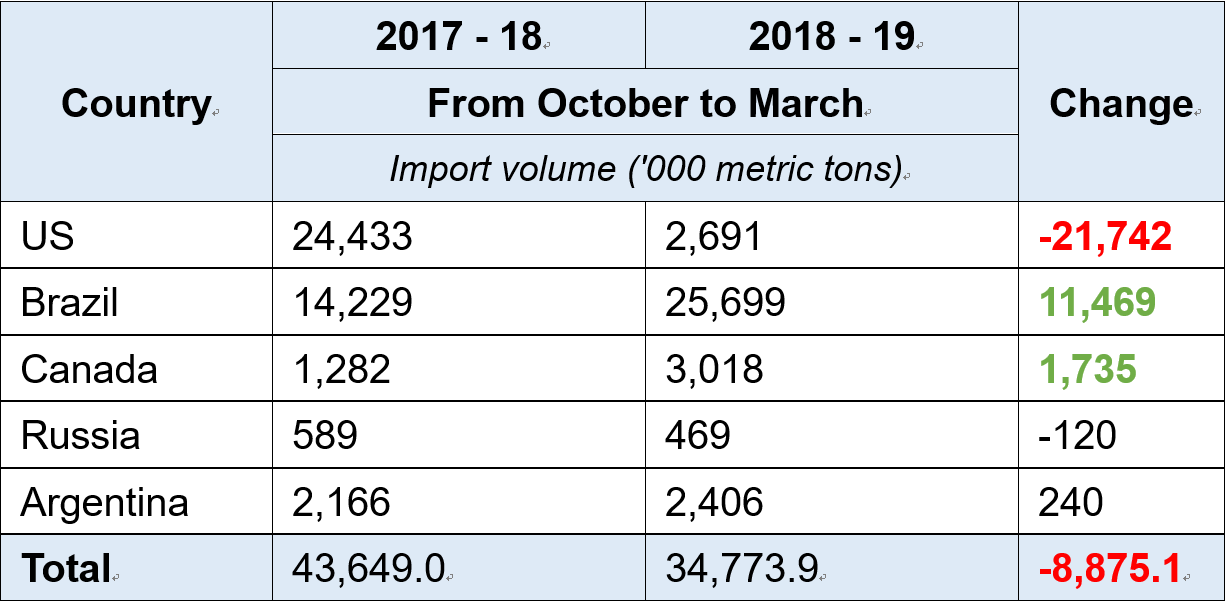

After the tariff took effect since July 2018, the import volume of US soybeans declined sharply, and China shifted to importing more Brazilian soybeans to help offset the significant decrease in the import volume of US soybeans. Nonetheless, the total import volume of soybean in China dropped along with the reduction of soybeans imported from the US.

The following table sets forth China’s import volume of soybeans by origins in the period of October-March 2017/18 and October-March 2018/19:

Sources: USDA; ShineWing research and analysis Sources: USDA; ShineWing research and analysis

Although China attempted to mitigate the damage by increasing imports from Brazil, it cannot fully make up to the loss of US imports, giving rise to the insufficient supply. As previously discussed, the import volume of soybeans consistently increased from 2013 to 2017, due to the increasing demand for soybeans. The decline in the import volume of soybeans has, therefore, translated into the supply shortage of soybeans in China. Yet, the Chinese government did not express much concern over the supply shortage in 2018 and early 2019 because soybean demand in China was also adversely affected by two incidents. First of all, African swine fever spread in China in 2018 reduced the number of livestock, and thus lowering the demand for animal feeds as well as soybean meals. Secondly, Brazil has a good soybean harvest since late 2018 given the favorable weather and soil condition, resulting in a boost of soybean export to China. The dampened demand for soybeans in China market along with the rising supply of soybeans from Brazil help to make up to the loss incurred by the reduced amount of soybeans imported from the US. In other words, the combined effects of these two events eased the impact caused by the sharp drop of imported US soybeans.

However, this does not imply import of US soybeans is not vital to China, especially the supply of soybeans from Brazil cannot fully substitute that of the US in the long term. Soybeans imported from the US and Brazil have distinct seasonal patterns corresponding to different harvest times in the northern and southern hemispheres. According to the USDA, the seasonal patterns of the US and Brazilian soybeans meet China’s demand every year, particularly the US dominates the import of soybeans between November and March every year while Brazil dominates the soybean market in the rest of the months. Furthermore, about 70% of Brazilian soybeans were already designated for export. Hence, there is not much left for Brazil to increase export volume of soybeans to China.

Persistence of interdependence and mutual benefits

To conclude, the world is likely to see the interdependence of soybean trade among China, the US, and Brazil persists. Demand for soybean in China will continue to grow despite at a slower pace. In the short-term, apart from Brazil, there is no immediate alternative soybean supplier in the world which can compare to the US. In parallel, there is no alternative market which can fully absorb the soybeans that are supposed to export to China from the US. According to Derek Haigwood, the chairman of the US Soybean Export Council, ‘You can’t produce another China, at least not overnight.’ Similarly, a big producer like the US cannot be created overnight. Importing soybeans from the US is important to China. In fact, it is a mutual benefit between China and the US, which US farmers produce soybeans that meet the demand from China market.

If the tariff on the US soybeans remains in place, the short-term impact of the US soybean exports is of the fall of soybean prices. The low soybean price will induce the US farmers to woo alternative customers other than China but the other markets will not absorb the entire volume required by China. Also, US farmers are likely to switch to the plantation of other crops, such as wheat or corns, in the long term. China will shift its soybean purchase from the US to Brazil and Argentina. Farmers from Brazil and Argentina, receiving a high price of soybeans offered by China, will expand its plantation of soybeans.

If trade restores and China eliminates the tariff, the low soybean price will likely prompt Chinese importers to resume the soybean procurement from the US. This will be the ideal scenario for both sides. China enjoys competitive soybean prices while the US does not have to suffer from losing its best customer in the world. In fact, the mutual reliance and the rule-based multilateral trading system are critical under the background of globalization. Neither the US nor China can separate itself from the global supply chain. This holds true even to the world’s two largest superpowers.

If there are any aspects which we may assist, please do not hesitate to contact:

Partner - Mr. Kevin Lam

Kevin.lam@shinewing.hk (Tel. 3583 8000)

Assistant Manager - Mr. Tom Huang

Tom.Huang@shinewing.hk (Tel. 3748 8231) |

|